What are Multi-cap funds?

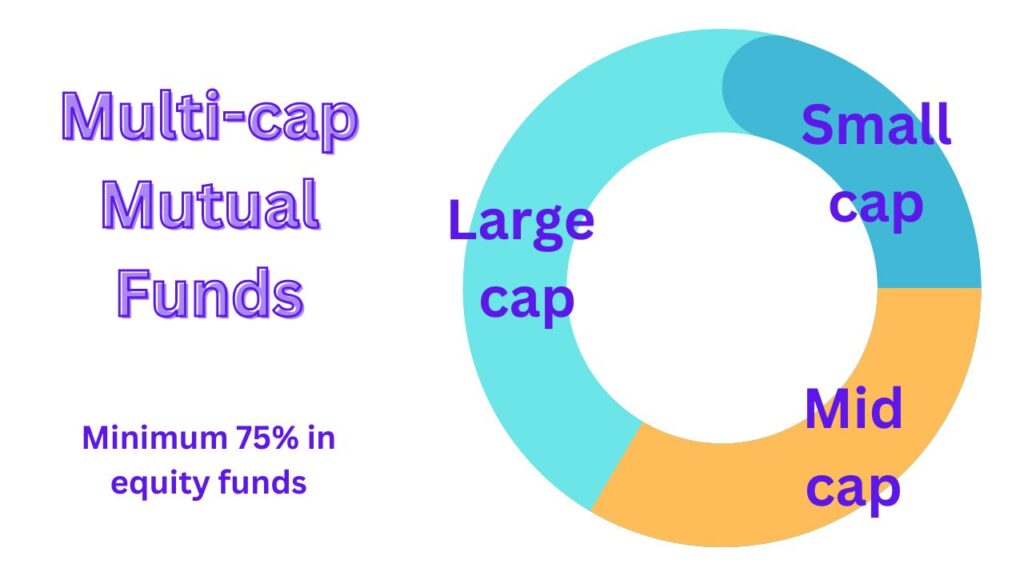

Multi-cap funds are a type of equity fund that invests in companies of all market capitalizations, i.e., large-cap, mid-cap, and small-cap. As per SEBI guidelines, any multi-cap fund needs to invest at least 75% of its assets into equity and equity and equity-related investments.

Benefits of investing in multi-cap mutual funds:

- Diversification: Multi-cap funds are one of the most diversified mutual fund categories, as they invest in companies of all sizes and sectors. This diversification helps to reduce risk and improve overall returns.

- Flexibility: Multi-cap fund managers have the flexibility to invest in any company, irrespective of its market capitalization. This allows them to take advantage of investment opportunities across the market spectrum.

- Potential for higher returns: Small-cap and mid-cap companies have the potential to generate higher returns than large-cap companies, due to their higher growth potential. However, they also come with higher risk. Multi-cap funds offer investors the opportunity to participate in the growth of small-cap and mid-cap companies, while also having the stability of large-cap companies in their portfolio.

Suitability of multi-cap mutual funds:

Multi-cap mutual funds are suitable for investors with a moderate to high risk appetite and a long-term investment horizon. They are also a good option for investors who are looking for a diversified investment portfolio.

Note – There is another category of funds called Flexi cap funds. Know the difference between flexi can funds and multicap funds before investing.

Things to consider before investing in a multi-cap mutual fund:

- Investment goals: What are you hoping to achieve with your investment? If you are saving for retirement, you may want to choose a fund with a longer-term horizon. If you are saving for a shorter-term goal, such as a down payment on a house, you may want to choose a fund with a shorter-term horizon.

- Risk tolerance: How much risk are you comfortable with? If you are new to investing, you may want to start with a fund that has a lower risk profile. As you become more comfortable with investing, you can gradually increase your exposure to riskier assets.

- Expense ratio: The expense ratio is the percentage of a fund’s assets that are used to cover the costs of managing the fund. A lower expense ratio means that more of your investment money is going towards investments.

- Past performance: It is important to look at a fund’s past performance before investing. However, it is important to remember that past performance is not indicative of future results.

How to invest in a multi-cap mutual fund:

You can invest in a multi-cap mutual fund through a mutual fund distributor or directly through the fund’s website. You can invest a lump sum amount or start a systematic investment plan (SIP). SIP is a convenient way to invest in mutual funds on a regular basis, such as monthly or quarterly.

Top Performing Multicap Funds 2023

Following is a list of Top performing multicap funds. They have shown consistency and are from good fund houses.

| Scheme Name | Benchmark | Riskometer Scheme | Return 1 Year (%) Regular | Return 3 Year (%) Direct | Return 5 Year (%) Regular | Return 10 Year (%) Regular | Daily AUM (Cr.) |

| Nippon India Multi Cap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 29.78 | 39.35 | 19.13 | 18.03 | 21,248.56 |

| Quant Active Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 18.20 | 34.78 | 24.27 | 23.05 | 6,123.53 |

| Mahindra Manulife Multi Cap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 24.22 | 32.10 | 20.67 | 2,232.89 | |

| ICICI Prudential Multicap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 25.33 | 29.93 | 15.39 | 16.71 | 8,983.64 |

| Invesco India Multicap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 21.86 | 26.88 | 15.61 | 18.78 | 2,756.67 |

| Baroda BNP Paribas Multi Cap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 20.09 | 26.85 | 16.71 | 15.51 | 1,904.09 |

| Sundaram Multi Cap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 17.93 | 25.65 | 14.38 | 16.71 | 2,110.69 |

| ITI Multi Cap Fund | Nifty 500 Multicap 50:25:25 Total Return Index | Very High | 25.84 | 23.32 | 674.49 |

Conclusion

Multi-cap mutual funds are a good option for investors who are looking for a diversified investment portfolio with the potential for higher returns. However, it is important to understand the risks involved before investing. You should also consult with a financial advisor to choose the right multi-cap fund for your individual needs and goals.