Understand Flexicap Mutual Funds

Flexicap mutual funds are a versatile investment option for Indian investors who are looking to build wealth over the long term. They offer the potential for higher returns than other types of equity funds, but they also come with a higher degree of risk.

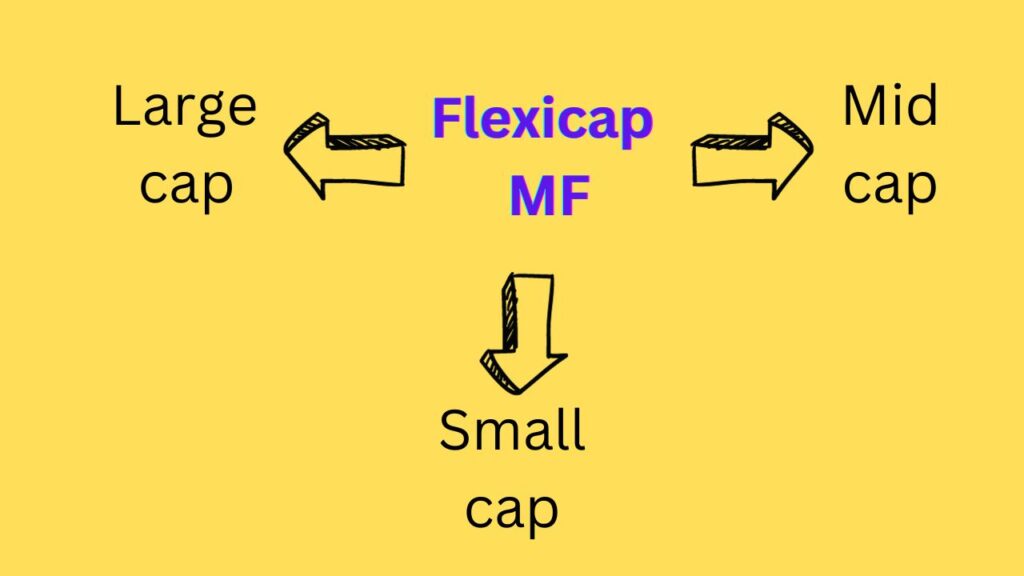

Flexicap mutual funds invest in combination of large cap, mid cap and small cap stocks. Based on the market conditions the mutual fund manager adjusts the allocation to these different market caps.

Flexicap mutual funds need to invest 75% of their corpus in equity oriented stocks. Out of this 75%, they can invest in any combination of market caps or they can increase allocation to one category based on market conditions. Due to this flexibility, they are called Flexicap Mutual Funds.

How to make money using flexicap mutual funds?

Here are some unique ways to make money using flexicap mutual funds for Indian investors:

- Use them to invest in thematic funds. Thematic funds are a type of mutual fund that invests in companies that are focused on a specific theme, such as technology, healthcare, or consumer goods. Flexi cap mutual funds can invest in thematic funds, which can give you exposure to high-growth sectors of the economy.

- Use them to invest in mid-cap and small-cap stocks. Mid-cap and small-cap stocks have the potential to generate higher returns than large-cap stocks, but they are also riskier. Flexi cap mutual funds can give you exposure to mid-cap and small-cap stocks while still maintaining a diversified portfolio.

- Use them to invest in cyclical stocks. Cyclical stocks are stocks that tend to perform well during certain periods of the economic cycle. For example, infrastructure stocks tend to perform well during periods of economic growth. Flexi cap mutual funds can give you exposure to cyclical stocks, which can help you to boost your returns during certain periods of time.

Here are some additional tips for making money using flexi cap mutual funds:

- Invest for the long term. Equity markets are volatile in the short term, but they have historically trended upwards over the long term. Therefore, by investing in flexi cap mutual funds for 5 years or more, you can give your investment enough time to grow and compound.

- Invest regularly through a systematic investment plan (SIP). This will help you average out your purchase price over time and reduce the impact of market volatility.

- Choose a flexi cap mutual fund from a reputable fund house. The fund manager’s track record is an important factor to consider when choosing a flexi cap mutual fund.

Who should invest in flexicap mutual funds?

Flexi cap mutual funds are suitable for investors who have a moderate to high risk tolerance and an investment horizon of at least 5 years. They are also a good option for investors who are looking for a diversified equity portfolio.

How do flexi cap mutual funds help in volatile markets?

Flexi cap mutual funds can help to reduce risk and volatility in a portfolio by investing in a diversified range of stocks. Since they can invest in companies of all sizes, fund managers can adjust the asset allocation of the fund to reflect the changing market conditions. For example, if the large-cap segment is underperforming, the fund manager can increase the allocation to mid-cap and small-cap stocks. This flexibility helps to protect the portfolio from downside risk and generate better returns over the long term.

How are flexicap funds good for long term?

Flexicap funds are a good option for long-term investors because they offer the potential for higher returns than other types of equity funds. This is because they can invest in a wider range of companies, including high-growth mid-cap and small-cap companies.

You can check the past performance of the flexicap mutual funds at the AMFI site. Please check the section later in this article that shows a list of top performing flexicap funds.

What kind of risks are associated with flexicap funds?

All equity investments carry some degree of risk, and flexi cap funds are no exception. The main risks associated with flexi cap funds are market risk and sector risk.

- Market risk is the risk of the overall stock market declining. This can affect all types of equity funds, including flexi cap funds.

- Sector risk is the risk of a particular sector of the economy underperforming. For example, if the technology sector is underperforming, it could have a negative impact on the performance of flexi cap funds that have a high allocation to technology stocks.

However, it is important to note that the risks associated with flexi cap funds can be mitigated by investing for the long term and diversifying your portfolio across different asset classes.

Top Performing Flexicap funds with strong track record

Based on consistent performance, we have listed below best performing Flexicap funds.

| Scheme Name | Benchmark | Riskometer Scheme | Return 1 Year (%) Regular | Return 5 Year (%) Regular | Return 10 Year (%) Regular | Daily AUM (Cr.) |

| Quant Flexi Cap Fund | NIFTY 500 Total Return Index | Very High | 19.14 | 24.29 | 23.37 | 2,156.02 |

| JM Flexicap Fund | S&P BSE 500 Total Return Index | Very High | 32.16 | 19.40 | 18.56 | 679.50 |

| HDFC Flexi Cap Fund | NIFTY 500 Total Return Index | Very High | 24.13 | 17.22 | 17.22 | 40,121.26 |

| DSP Flexi Cap Fund | NIFTY 500 Total Return Index | Very High | 22.42 | 17.14 | 16.83 | 9,193.46 |

| Franklin India Flexi Cap Fund | NIFTY 500 Total Return Index | Very High | 22.54 | 16.40 | 17.01 | 12,294.30 |

Conclusion

Flexicap mutual funds can be a good option for Indian investors who are looking to build wealth over the long term. They offer the potential for higher returns than other types of equity funds, but they also come with a higher degree of risk. It is important to carefully consider your investment goals and risk tolerance before investing in flexi cap mutual funds.

Note – There is another category called Multi-cap Funds. You should understand how Flex-cap funds are different from Multi-cap funds before investing.

Additional Tips – Unique way to invest in flexicap mutual funds:

Here is a unique way to invest in flexi cap mutual funds:

- Invest in a flexicap mutual fund that has a focus on sustainability.

Sustainability is a growing trend in the investment world, and companies that are focused on sustainability are becoming increasingly attractive to investors. Flexicap mutual funds that invest in sustainable companies can offer investors the opportunity to generate good returns while also making a positive impact on the environment and society.

Another unique way to invest in flexicap mutual funds is to use a dynamic asset allocation strategy. This involves adjusting the asset allocation of the fund based on the changing market conditions. For example, if the fund manager believes that the market is overheated, they may reduce the allocation to equity and increase the allocation to debt. This can help to reduce risk and volatility in the portfolio.

Finally, you can also use flexicap mutual funds to invest in specific market themes. For example, you could invest in a flexicap mutual fund that has a focus on the digital economy or the healthcare sector. This can give you exposure to high-growth sectors of the economy while still maintaining a diversified portfolio.

Here are some examples of how you can use flexi cap mutual funds in a unique way:

- Invest in a flexicap mutual fund that invests in companies that are developing new technologies to address climate change. This could include companies that are developing renewable energy technologies, energy-efficient technologies, or carbon capture technologies.

- Invest in a flexicap mutual fund that invests in companies that are developing new treatments for diseases or that are providing healthcare services in underserved areas. This could include companies that are developing new cancer drugs, new vaccines, or new ways to deliver healthcare to rural populations.

- Invest in a flexicap mutual fund that invests in companies that are committed to social responsibility. This could include companies that have strong environmental policies, that promote diversity and inclusion in the workplace, or that give back to their communities.

By thinking creatively about how you can use flexicap mutual funds, you can develop an investment strategy that is tailored to your specific needs and goals.